Introduction

Welcome to the Fifth edition of my “Tools for Early Startup Founders” newsletter!

In this edition, we’re going to learn about Cashflow.

Cashflow can be a tricky subject—even for seasoned founders. Many businesses fail not because of lack of customers or ideas, but because they ignore tracking and maintaining a healthy cashflow.

To make things fun (and easy to understand), let’s explore this concept through the story of a fictional lemon-based startup called “LemonMania.” 🍋

LemonMania: The Origin Story

Meet Prof. Citron, a quirky inventor from a mountain town called Sourless.

Now, Sourless wasn’t always sour—it got its name from the volcanic soil that simply couldn’t grow citrus fruits. The townsfolk depended on lemons shipped from Downhill. But because of distance and demand, lemons there were 100x more expensive.

Tired of this struggle, Prof. Citron invented something revolutionary: a genetically modified lemon that could grow in Sourless soil!

There was one problem though… these lemons grew only during peak summer—fast and in excellent quality—but barely survived in other seasons.

Prof. Citron realized that selling lemons directly wouldn’t work. Demand was year-round, but supply was seasonal. So, he put on his entrepreneurial hat and asked: “How can I give people lemons whenever they want them?”

After speaking with locals, he discovered:

- In summer, people loved making lemonade.

- In winter, lemons were a luxury, used to add sourness to food.

That’s when he spotted the market gap. His value proposition was born:

“Lemon that we deserve anytime.”

Thus, LemonMania was born with two products:

- Fresh Lemonade for summer.

- Lemon Pickle for all other seasons.

LemonMania: Getting Started

With an idea in hand, Prof. Citron pitched to the wealthiest landlord in town—Mr. Shark.

Mr. Shark loved the idea. He could smell profits from miles away. But being cautious, he didn’t want to risk big money upfront. Instead, he offered:

- A loan of ₹1,00,000 at 10% interest, repayable in one year.

- Free land lease to start cultivation.

- Monthly interest payments, split equally.

- A condition: Prof. Citron must submit a clean Profit & Loss statement and Balance Sheet every month.

If LemonMania proved profitable, Mr. Shark promised a ₹10,00,000 investment plus a long-term concession on land lease.

Excited, Prof. Citron wasted no time. He opened a bank account for LemonMania, and soon the first ₹1,00,000 was transferred by Mr. Shark.

The journey had begun. 🚀

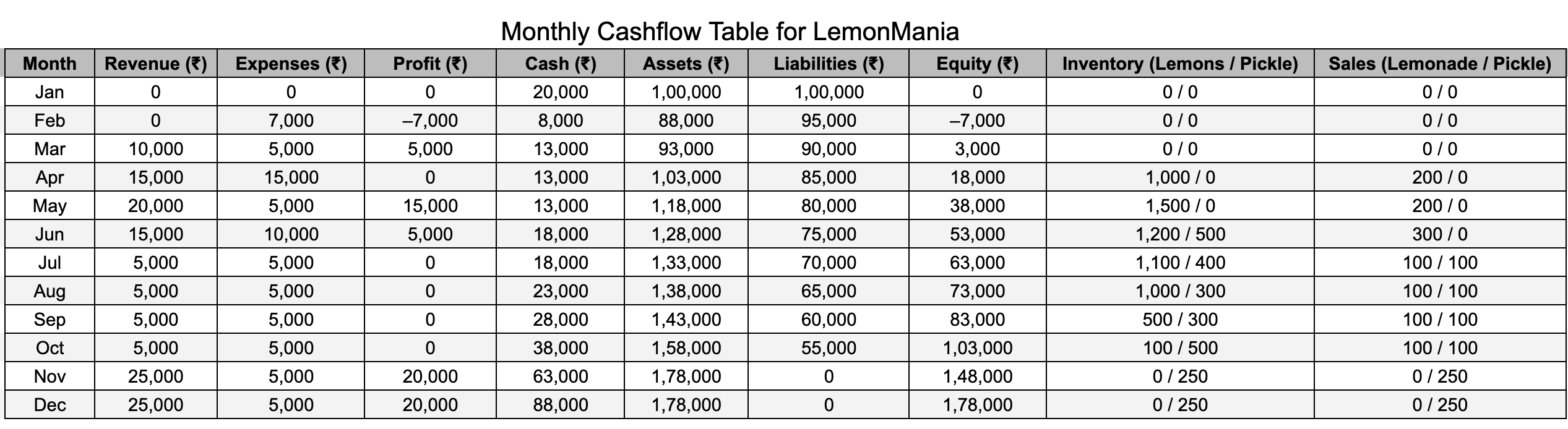

LemonMania: Prof. Citron’s Cashflow Journey

January - The Busy Lab

Prof. Citron opened his shiny new lab, full of equipment and gadgets. It looked impressive, and everyone thought he was ready to conquer the lemon world. But soon he realized that a busy lab doesn’t mean money in the bank. Lesson one: cash is the lifeblood of any business.

February – Tiny Sprouts, Big Responsibility

The first lemon saplings peeked out of the soil. Prof. Citron spent on labor and fertilizer, and even made a small loan payment. He quickly learned that liabilities need to be matched with cash or incoming revenue, or stress will creep in.

March – The Side Hustle Trick

Flowers bloomed, bees visited, and pollination began. To keep money flowing, Prof. Citron sold a few saplings to townsfolk. Lesson: small side hustles can help bridge cash gaps while waiting for your main product to be ready.

April – Lemonade Dreams

The first lemons were ready, and Prof. Citron set up a lemonade stall. Customers lined up, and excitement soared. But despite the crowds, he realized that strong sales alone don’t guarantee profit—focusing on the bottom line (profit) is what counts.

May – Stocking Up for the Future

With excess lemons in hand, Prof. Citron began pickle production and stored inventory for upcoming months. He learned that inventory is an asset until it’s used or sold, and managing it wisely is key to smooth operations.

June – Smooth Sailing

Lemonade continued to sell, and pickles were being prepared for the season. Operations ran smoothly. Lesson: predictable cashflow gives your business breathing room to work without panic.

July to October – Slow Seasons

Lemon harvests slowed, but pickle inventory kept the business going. Sales were modest, and Prof. Citron faced quiet months. He realized the importance of keeping some cash liquid and not tying up everything in fixed assets, so the business could survive slow periods.

November to December – Peak Pickle Time

Pickle sales surged, and the loan was fully repaid. The business was finally thriving. Prof. Citron learned that healthy cashflow allows you to plan for growth and take strategic steps without fear.

The Year’s Wisdom

Through the journey of LemonMania, Prof. Citron discovered that flashy facilities, big sales, or rapid growth don’t guarantee success. The true heroes of a business are cash, inventory management, careful attention to liabilities, and planning for both busy and slow periods.

Thank you!

Your enthusiasm is what motivates me to spend time every week creating content in a format you’ll enjoy and learn from.

I’m a huge fan of the open-source community, without which I wouldn’t have build a successful career. Now, I want to give back by sharing my knowledge with anyone who might find it helpful in building a career as a Software Engineer, or Entrepreneur.

For new subscribers who missed my previous newsletters, you can find the links here.